People ask me all the time: what should I invest in?

I reply, kindly of course: “I cannot answer that.” What I can tell you, though, is where I am investing and why. If I had to categorize my entire investment philosophy it would be something close to this:

Old and boring (for investing).

New and exciting (for income).

I’m not saying you shouldn’t invest in tech (I do), I am simply saying that as a general philosophy, I want old, boring, time-tested, stable kinds of assets making up the bulk of my portfolios.

That means real estate. That means permanent insurance. That means boring businesses that have been around a long time. And, lately, crypto.

Crypto is not old. And it’s anything but boring. But it is likely the future and as of now, it may be more sustainable than any other asset class of all time (particularly referring to Bitcoin).

I laugh at those who say “Bitcoin is dumb it has no utility do not buy.” I promise you, a quick review of their assets would reveal fiat cash. There is less utility in fiat cash than there is in Bitcoin. More on this another time — needless to say, you can tell the people who have studied true macro and those who pontificate on social by how they speak about Bitcoin.

That is not what this post is about, I digress. This is about real estate; more specifically, why (a) we are not in a bubble and (b) I am RAPIDLY scaling my holdings.

What Causes a Bubble?

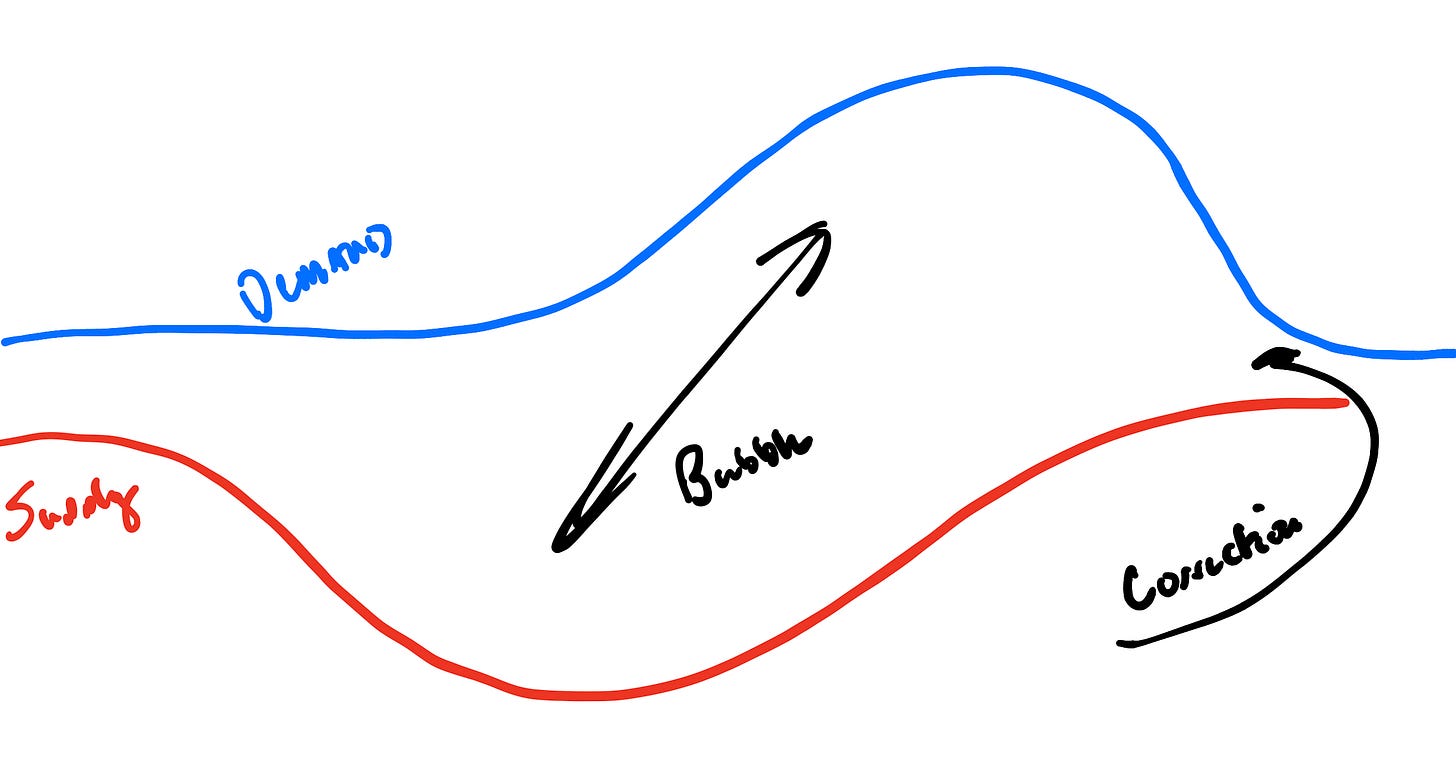

To claim that real estate is a bubble assumes you have some semblance of understanding around what a bubble actually is. Simply put, a bubble is the timed distance between when an asset’s DEMAND increases, and when the SUPPLY catches up and thus LOWERS demand.

This can happen both ways: demand can increase first and supply can’t keep up. OR, supply constraints can happen and thus demand increases.

As they say, “What goes UP, must come _______.” Ahh, but then there is inflation. And THEN, there is the idea of a “regulated supply.” The reason gold, for instance, has grown consistently over the ages is two-fold:

There is only a ~2% annual increase in supply (average)

Inflation keeps the dollar devalued against gold supply

Real estate can be placed (at times) into the same general category.

The idea of a real estate “bubble” happening is a legitimate idea. When people refer to the 2008 real estate “bubble” they are mostly referencing a banking crisis, not an actual supply/demand imbalance.

However, where we are right now is a supply/demand mismatch that will take a very long time to fix. This is due to, as discussed, an imbalance in supply & demand. However, another indicator people are missing is the increased liquidity of first time homebuyers. The key word is: LIQUIDITY.

This does not mean income has increased, it means liabilities and other necessary spending has decreased. Keep in mind that all opinions are just that, opinions. Who knows — but this is my thesis and why I am doing what I am doing.

So we have not one, not two, but THREE convergences that are pushing prices of real estate (particularly, single family residential real estate) higher and higher.

The first is supply & demand. The second is inflation (dollar denominated assets are all getting more expensive). The third is liquidity, which is translating to more homebuyers.

And before we single out home ownership, let’s also talk about the growth in LEASES for single family real estate:

The bottom line is this: there is not enough inventory, and as people RACE away from the large (densely populated) metros into the higher “quality of living” cities, we are seeing places like Charlotte, Nashville, Austin, Phoenix, Oklahoma City, Raleigh (to name a couple) BOOM.

Charlotte needs 21,000 new single family homes. Only 3,000 on the docket for next few seasons. Nashville needs 19,000 new single family homes. These places are experiencing record high growth and not enough inventory.

The thing people are not fully grasping is this: it will take years to catch up inventory. And by then the dollar will be worth less than it is today. You will see real estate continue to boom as long as there is (a) demand, (b) inflation, and (c) safe lending laws.

The third point is thrown in for good measure so we do not repeat 2007-2008. As long as that doesn’t happen, I don’t see a correction coming. This is a new normal that we a few will profit from and the rest will wish they had.

How am I capitalizing on this?

First, through safe investment practices. It doesn’t make sense to over-leverage on any asset class. The potential upside never justifies the overreach. Your job, as an investor, is to only lose what you can afford to lose. ANYTHING that takes you out of the game does not justify the upside.

There are three main ways I am investing in real estate:

Value add

Syndication

Development

When people ask me how to break in, I always tell them to do what I did: find a partner, syndication, or JV. When you go it alone the first time, real estate turns especially speculative (at least, more speculative than it should be).

From there it’s all about covering any and all downside with the optionality required to cut your losses.

If I have $10M tied up in debt, I need at least $40-50M tied up in portfolio value so that I can cut losses on any single deal that is not working. Most people think only of the upside — but you must consider the downside.

The same can be said for crypto. At a later time, I will talk about how I am using crypto assets to enhance my real estate assets. Not enough time in this article, but know that this is on the docket.

Until then, be safe, keep learning, and happy investing.

-T

P.S. If you’re not part of any of my other networks, you should fix that via whichever channel/platform you prefer:

Levels of Wealth Telegram channel

Levels of Wealth Facebook group

More interesting links: