On Making More Money

…and why it will not save you

There are some massive sh*t storms incoming.

I don’t tend to fixate on the negative very often. I’m a glass-half-full kind of human. What I’m writing to you about right now is not a demonstration or evidence of “pessimism,” it’s just math.

To ensure you fully catch what is happening in the world right now, a brief rundown on wealth inequality.

Capitalism Is At Fault

…Except — it’s actually not.

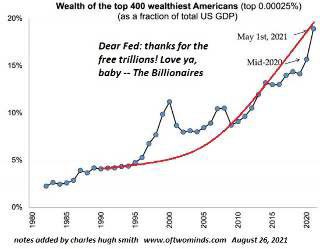

Here is what the narrative is saying: “Greedy bastards at the top are stealing from middle class Americans in the middle.” In reality, here’s what’s actually happening: Federal Reserve is padding every rich person’s balance sheet with extra cash.

The “return on capital” is so far out ahead of “return on labor” that there is no catching up. Let me tell you a secret: nobody at the top thinks we can fix this with higher wages. That’s a facade.

If you change a $15/hour employee to a $20/hour employee you are bumping up their income (marginally, at that). If you then go out and create $5 trillion of money supply, that $20/hour gets 15% (best case) to 20% (worst case) shaved off of it.

Let’s do the math:

$15 to $20 hourly = $5 per hour raise

80% of $20 = $16

Buying power = $1 per hour more

Businesses lay off talent and the entire middle/lower class gets poorer

The narrative says “Politicians are stupid.” They’re not. They’re incredibly smart and they know we are playing with fire.

The Only Solution: Convert Your Fiat

This is not financial advice nor can it be treated as such. I don’t care what you do — but I will tell you a bit of what I am doing so that you can learn or not learn (up to you).

Every dollar that enters my ecosystem is treated as an employee. I do not want it sitting idly in a bank account. People will tell you to store as much cash as you can… some say as much as 50% of your net worth via cash.

Classify this as some of the worst financial intelligence of all time. You are locking in a 100% guarantee of devaluation (aka your money will get less valuable). People have to pay attention and learn how to read… if you can’t read, this all gets complicated real fast.

Let’s say I bring home a million dollars. I need to pay some tax on that, so 25% gets cut out. I enjoy eating food, having a place to live and not having to walk everywhere — so that’s another 25% in living expenses (aka “burn”).

I will then employ a creative suite of strategies to decrease my “liquid” cash on hand and prop up my cash equivalents/assets. If something were to happen, I want to retain access to what the cash can do for me — I’m not stupid. But you also must decide whether you want to live your life in a “zero sum” manner or a “win/win” manner.

I choose “win/win,” which means I’m going to try to get my cash productive without losing it’s optional liquidity.

HELOCs

Whole Life insurance

Margin loans on securities

Etcetera etcetera

I don’t have time to get into every single step or class here, but I want you to catch the train of thought. Convert out of fiat and into something backed by a harder-to-create asset. At this point, crypto would enter the list. Bitcoin is the hardest money supply in the history of the world. And you can create liquidity from it at this point.

Here’s the deal: this is not me telling you what should do. It’s me telling you how to not get eaten alive.

The world is changing quickly and the narrative being shoved at everybody is this: it’s fine, don’t worry about it… inflation is a good thing. Umm.. what.

The reason the wealth gap exists is BECAUSE of inflation, and a total lack of self control through the last 100 years. One one hand, outlets say “look at the inequality, capitalism BAD.” On the other they say “inflation is fine, don’t worry about it.” It’s massive misdirection and you have to pay attention to it.

If you want to go deep on this, check this thread out:

For proof that the world has gone totally mad, check this out:

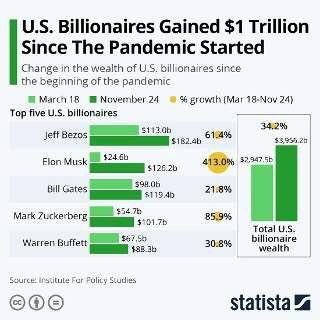

And, as a demonstration of what I’m talking about regarding the wealth gap (aka return on capital VS return on labor):

What’s the play?

The play is to continue to increase your income, sure. BUT - you must also take the idea of “fiat conversion” seriously. In a world where most teach “cash minimums” and “emergency funds,” I am actively capping my cash on hand with a maximum. Why?

Because cash, by itself, is one of the most unproductive assets you can have (unless you are a hedge fund). One person messaged me a few days ago on Twitter, “Taylor - why do you cap your cash? Warren Buffet keeps billions in cash.”

What you must realize is that if YOU were worth $100 billion then keeping $20 billion COH is only 20% of NET WORTH. And do you have any idea the return on capital is for a hundred billion dollars?

Hedge funds are playing with house money. They sit and wait and buy entire companies for cash (LBOs not withstanding). If you’re in that line of work and would like to do the same, go for it. If you’re just wanting to set up your financial future to survive & enjoy — you should not play the same way. Sometimes the fastest way to die is this: try copying someone who is several thousand steps ahead of you. Find the people who are 5-10 steps ahead, ask them what they do, model.

Will stick around for questions if you have any in the comments. This is serious stuff, but opportunity abounds in problems. As they say, “Necessity is the mother of invention.” Everybody wants the invention, but they complain about the necessity.

Onward & upward.

-T

The curve tricrypto2 pool is a good example of yield on assets. Borrowing through abracadabra.money

Great stuff. For the average person in a “stable” job, can you give a rough guideline for how much cash you would keep on hand in terms of monthly expenses?